Connext Ecosystem #2: FujiDAO

A deep dive into FujiDAO: What is it, how it works, a brief history and the decision to integrate Connext

What is FujiDAO?

FujiDAO is a cross-chain borrowing aggregator. It aims to optimize loan expenses for DeFi users by constantly monitoring borrow markets and whenever there is a better rate, it automatically refinances the whole pool of debt. FujiDAO aims to make borrowing more accessible to users while the borrowing markets in DeFi are still maturing, and the infrastructure that will make the market liquid and fluid is still being built. Connext Network is used for its cross-chain enhancements.

Why should you borrow on FujiDAO when you could use the base protocol directly? Many useful reasons why:

cost optimization — minimize the interest paid by borrowers

economics of scale — pooling funds together reduces the transactional costs by sharing fixed costs

time-saving — removal of constant attention users need to pay to find optimal rates

smooth UX — manage easily all debt positions from one place

How it works

Fuji DAO creates vaults where users deposit a single asset as collateral and borrow against it another asset. For example, in the ETH/DAI vault, users deposit ETH and borrow DAI. Thus, isolating debt positions allows for better risk management and the most effective interest rate optimizations.

All-in-one smart borrow

When users borrow from a Fuji vault, the needed liquidity gets sourced directly from the base protocol proposing the best rate (Compound, Aave, dYdX, and more to come).

The protocol keeps track of users’ individual positions and assures the overall vault’s health through a classical liquidation mechanism. To avoid liquidation, users need to maintain the proportion of their debt to the amount of collateral they provided above a certain threshold.

Fuji constantly scans borrow markets

When market conditions change and there’s a provider with a lower borrow rate for a certain asset, the protocol triggers a rebalance operation and refinances the whole position of the vault. In that way, users instantaneously get a better rate on their loans without the need to take any action on their side.

A Brief History and the Birth of xChain Borrowing Aggregator Idea

FujiDAO was born during ETHGlobal “MarketMake” hackathon in January 2021 and this is where the founders met.

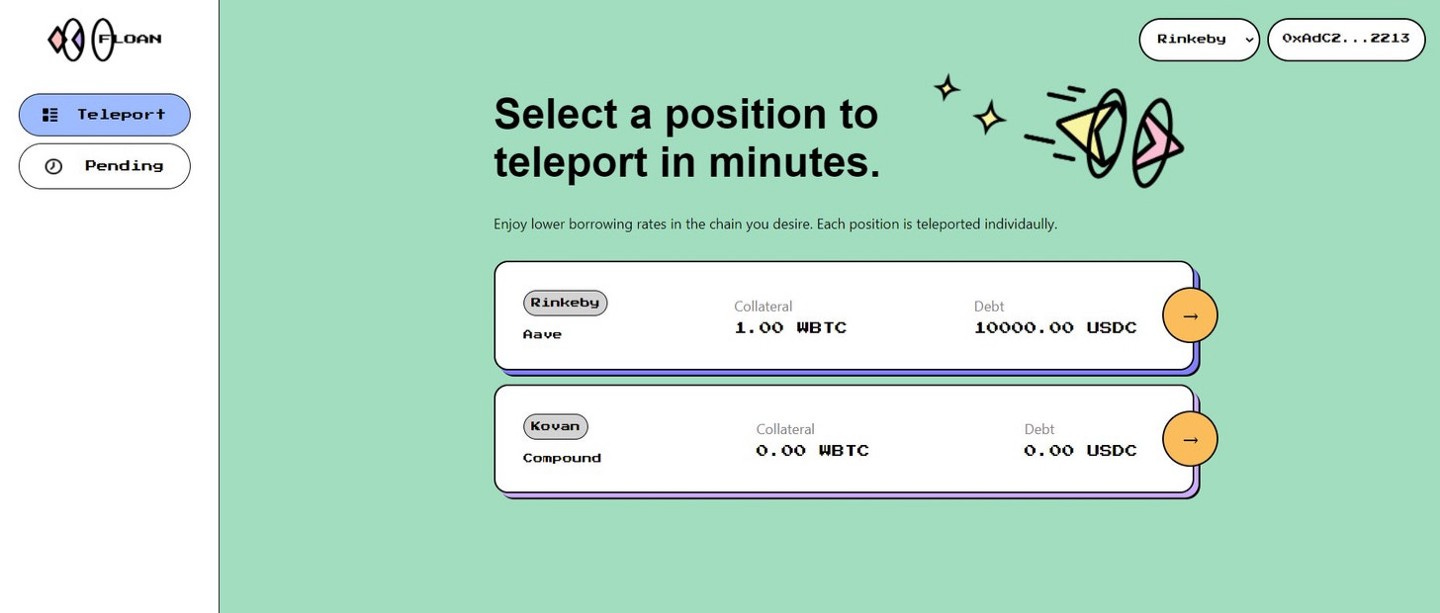

In ETHGlobal’s recent hackathon ETHAmsterdam, FujiDAO Team hacked ‘Floan’ and became one of the 13 Finalists.

FujiDAO Team came up with the idea of Floan thinking of more users wanting to avoid operating in Mainnet due to the high gas fees.

They designed a system that enables the user to bypass the cumbersome process by offering a 1-click beam of their debt position (collateral + debt) to the desired chain where they will enjoy cheaper borrowing rates. Connext Network was used to bridge the assets as a signed xcall in the project.

Currently, the team is working on bringing FujiDAO to the cross-chain world by building an xChain Lending Aggregator with Connext.

FujiDAO Team will build the first xChain Lending Aggregator among their already gained title as the first Lending Aggregator ever in DeFi.

What is xChain and how different is it from multichain?

Multichain is where you use dApps like Aave, Yearn or Curve on multiple interfaces on many chains. They act like different apps, siloed from each other.

Cross-chain, or as Connext names it, xChain is:

When there is one interface that aggregates data from all chains so that users have a single consolidated experience.

xChain lets you recognize user balances and actions from any supported chain regardless of where the user initiates their interactions from.

xCall = Routing transactions to any chain.

Connext lets users call to any receiving chain contract in a single step, or even directly connect your contracts to one another.

xApp = App that has a single interface allowing users to access liquidity or data from any chain.

Users don’t even have to understand which chain they are on, it’s just seamless interaction.

Cross-chain borrowing: deposit collateral on Chain A, borrow loan on Chain B

Users will be able to add collateral on chain A and borrow another asset on chain B with the best rate across chains thanks to FujiDAO’s routing system which ensures users get the best borrow rate and so seamlessly with Connext‘s xChain operations explained above.

Connext lets builders create secure xChain dApps (xApps). Connext Network is the only way to build xApps that retain the security of underlying blockchains.

Team behind FujiDAO

With 6 passionate #BUIDL’ers in total behind FujiDAO; Boyan (Co-founder), Daigaro (Co-founder), @iafhurtado (Product Lead), @0xtiagofneto (Solidity Developer), @guill__om (Frontend Developer) and @PragueBrewer (Community Lead). Boyan was in Web2 and finance before co-founding FujiDAO. Daigaro was in the Aerospace industry for 9 years, started learning Solidity and has been building ever since.

About FujiDAO

FujiDAO is a Borrowing Aggregator optimizing your costs in DeFi by automatically refinancing your loans across different markets. The app is already live on Ethereum & Fantom and will be available soon on Polygon, Arbitrum and Optimism.

Website | Blog | Docs | Twitter | Discord

About Connext Network

Connext is a network for fast, trustless communication between chains and rollups. It is the only interoperability system of its type that does this cheaply and quickly without introducing any new trust assumptions. Connext is aimed at developers who are looking to build bridges and other natively cross-chain applications.